Getting a paycheck is quite exciting, but in that rush of excitement, you might spend more than you should. So, how do you minimize spending and make sure that your paycheck lasts longer? This article will cover nine clever ways you can do just that.

-

Work With a Budget

Budgeting is an important life skill that everyone should have regardless of what stage in life they are in. It is especially important when you start receiving a paycheck. This is because you do not want to live paycheck to paycheck.

Hence, you need to track how much you spend weekly and monthly. You can then use this figure to create a budget. This way, you always know what to expect when you look at your account balance.

-

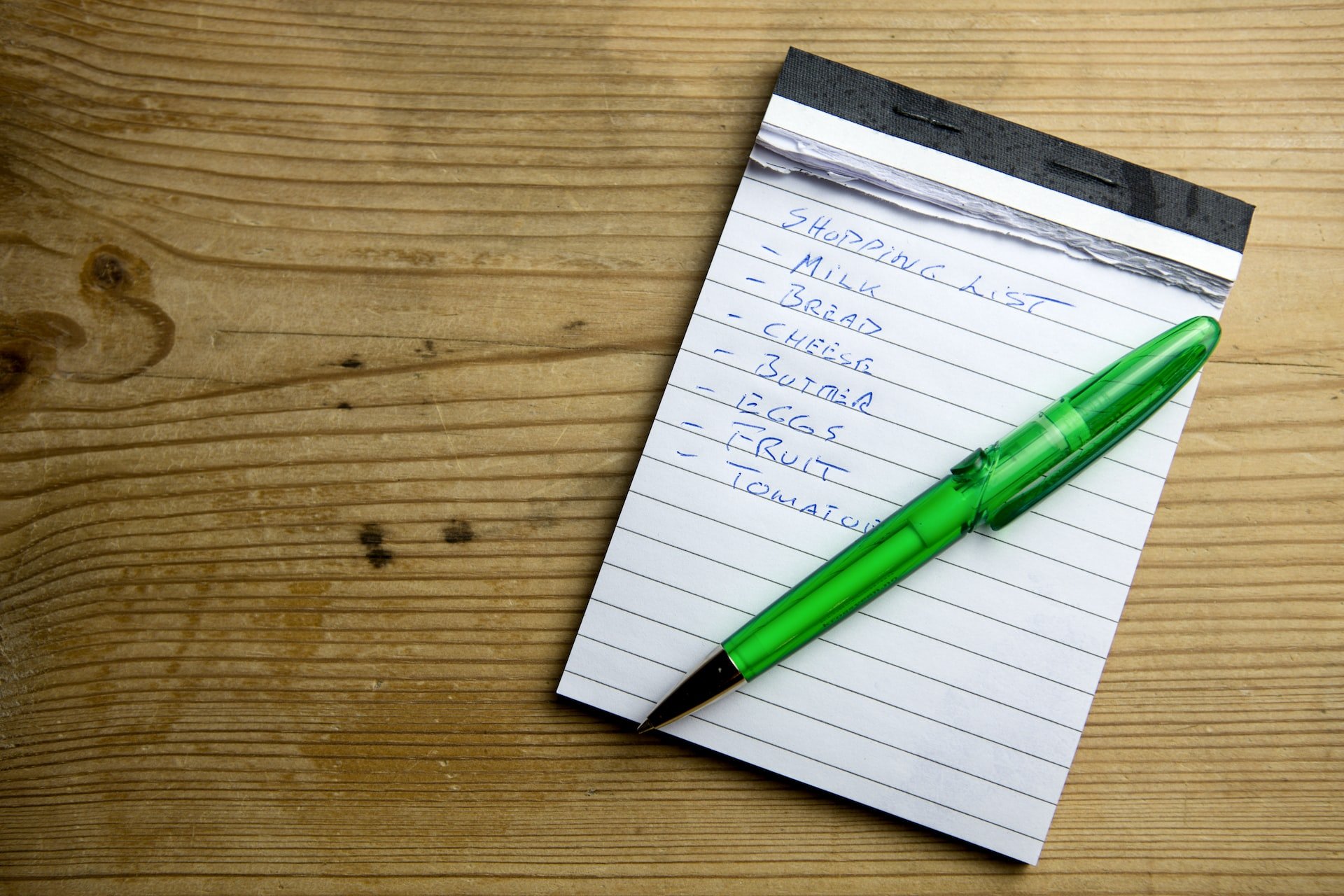

Create a Master List

Have you ever walked into a store to buy a few items and ended up leaving the store with a trolley? Well, it happens to many people who regret these purchases in most cases.

Have you ever walked into a store to buy a few items and ended up leaving the store with a trolley? Well, it happens to many people who regret these purchases in most cases.

So, to avoid making this mistake, you should make a master list of everything you need to purchase. You can start with groceries. Create a list of everything you need to purchase, then head to the grocery store and only buy items on that list.

You can also create a list of other things, such as clothes, shoes, and cosmetic products.

-

Sort Out Your Bills First

It is always an excellent idea to pay your bills before spending whatever is left. This is a vital way to make your paycheck last longer.

After settling all your outstanding bills, you can create a budget for things that are not necessities. For example, you can spend the leftover funds on clothes, shoes, or outings with friends.

Furthermore, paying your bills on time can help you maintain your credit and improve your budgeting skills.

-

Request for a Raise

Making more money means your paycheck will last longer, right? Well, you can increase your income by simply asking for a raise.

Requesting a raise should not be something you fear, especially if you deserve it. Besides, asking might be the only way to get one.

Before asking, research and confirm how much other people in your field are collecting. Furthermore, be ready to explain yourself and why you believe you deserve a raise.

-

Avoid Overspending

Another way to make the most out of your paycheck is to limit how much you spend. Essentially, try not to spend money on things you do not need. For example, you could cut back on the number of snacks you buy.

Besides cutting back on what you buy, you can also start purchasing generic products and avoid name brands. You can also consider using coupons.

Another valid method is buying items in bulk and then splitting the bill with your friends. All these are habits that go a long way in extending your paycheck.

-

Find a Part-Time Job

Similar to a previous point, your paycheck can last longer if you make more money. Hence, getting a part-time job is not a bad idea. Adding a part-time job to your full-time job is not impossible, and a lot of people do it.

If you work up to a point where your primary job funds your lifestyle, then you can save up all the money you make from your secondary one. If not, you use both to ensure you make ends meet.

It doesn’t even have to be an on-site job. You can consider starting an online business, which can be your second source of income.

-

Divide Your Paycheck into Two

Splitting your paycheck into two is mostly adopted by students, but it works for everyone. This method aims to put part of your money in your account for essential expenditures and the other half into savings.

Remember that this method only works when you have sorted out your fundamental monthly bills.

One major benefit of splitting your paycheck is that you can build long-term wealth using your savings. If you would rather not save money by yourself, you can automatically set your account to deduct a certain monthly amount.

-

Stay Away From Credit Cards

It is easy to get lost in a spending frenzy when using credit cards because bills do not appear until the end of the money. Also, you do not lose any money from your checking account until that time.

To an extent, these items you purchase might seem free. However, they come with high-interest rates that can affect your credit if not paid. In addition, paying these high-interest credit card balances does not allow you to maximize your paycheck.

Sometimes, you might need to take out loans to pay off these balances. At the end of the day, you might ask yourself, “how many payday loans can you have in Louisiana?” just because you want to clear off your credit card balance as soon as possible.

Thus, you should always opt for cash payment or use a debit card. This way, you can feel the immediate impact of what you are spending.

-

Share Your Financial Goals With Someone

Having financial goals is fantastic, but people tend not to share these goals due to fear of failure. However, sharing these goals with friends or family is best because they help keep you accountable. According to research, people who write down their goals and share weekly updates with friends increase their chances of success by 33%.

Conclusion

Cutting down on costs and making the most out of your paycheck is what most people should strive for. However, knowing how to do this can be challenging. Hopefully, the nine tricks in this article can help you do just that.

Also Read: Payroll Best Practices To Follow In 2021