For outsiders, the stock market movement may seem like an ocean with waves going up and down. Predicting stock market prices and movement is a very challenging and difficult task. It involves anticipating market direction, sectoral trend analysis and movement in the price of the stocks in the stock market itself. This is where the AI stock price comes in handy.

Macro trends affecting the broader market and market players and their roles need to be identified. Also, fundamental changes in the stocks need to be taken into account along with the impact of the latest happenings, political events and news impacting the stocks. All things said and done the most difficult challenge will be to anticipate the investor psyche and sentiment which also plays a big role in decisions relating to the stock market. It is to be noted that movements in the stock market are not random. They are highly nonlinear and move dynamically based on events.

Understanding the Stock Market

To get a better understanding one must understand what the stock market is. The stock market is a trading platform where buyers and sellers come together to exchange securities. The most commonly known securities are shares in companies, gold, bonds, and commodities. The stock market index represents the combined movement of the prominent stocks within the stocks listed on that index. If there are more buyers than sellers the stock moves up and if there are more sellers than buyers the stock moves down. There is a constant buying and selling happening during market hours and this buying and selling make the stock market index move. The great thing about the stock market is since almost all trades these days happen online with machines handling the processes, a lot of measurable data with regards to every aspect of the stock market is readily available to work with. Also, be it investing, trading or portfolio management, over the years many theories have been published and propagated to optimize returns and reduce risk.

Stock market success is not only determined by finding good stocks to invest. A great deal of how much profit one makes also relies upon at what price point one is able to exit and enter a particular stock. That in itself requires a better understanding of trading volumes at play, trend analysis and optimizing the timing of the trades. Quick analysis, sharpness, and speed are some of the essential aspects in this and algorithm trading platforms are able to provide that edge.

In order to learn and understand stock trading and investing from the beginning, you can explore various sections of “Stock Trading & Investing for Beginners” guide. It gives you in-depth insights into stocks, the stock market, stock exchange, financial intermediaries, stock index, understanding financial statements, common size analysis, financial ratio analysis, Candlesticks patterns and much more!

Algorithmic Trading Edge

Algorithmic trading has already garnered a massive share in the US equity market with over 60% of the trades done in equity market done by algorithms and it is fast growing in other global markets. Algorithm trading is employed by retail investors, mutual funds, hedge funds, pension funds, insurance firms, and big institutional trading houses to trade in stock markets on low latency networks. These algorithms are pre-programmed for split-second decision making and sending trade orders to the exchange while taking minimal decision-making time based on variables such as pricing, market factors, volume, time, etc.

With evolution in machine learning algorithms and the abundance of stock market data available, it is very much possible that instead of just pre-programmed algorithms managing trades, machine learning algorithms will be able to learn from past data and forecast stock market movement and make better judgments than humans. Also, stock market predicting can be many things – it can be a prediction of volatility, prediction of prices in the market or the general direction the market will take. All of this is valuable information for a market trader.

AI Assisted Stock Market Trading Desks

AI stock price has been assisting stock market traders and influencing investment decisions for some time now. Over recent years, financial institutions and asset managers have been trying to introduce AI and machine learning to their operations to give them the cutting edge. Trading desks relying on AI for prediction of the trend, scouting for undervalued stocks and to make sense of the flood of data are now common.

There are several Artificial Intelligence ETF in the US stock market which invests in companies employing AI in their processes. Often the funds themselves are using AI for managing their portfolio. Recently Pagaya Investments had claimed to have launched the world’s first Asset-backed security consumer credit fund which was wholly managed by AI. It is claimed that the AI will analyze 1.5 lakh variables of every borrower to which it lends to.

Predicting Stock Market Using AI

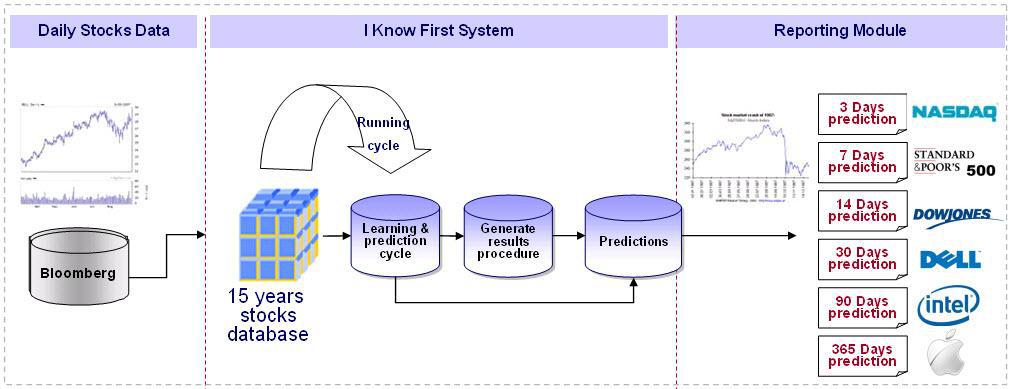

Already there exist portals like iknowfirst.com. It is a financial firm that utilizes an advanced self-learning algorithm to analyze, model and predict the stock market. It is co-founded by Dr. Lipa Roitman, a scientist, with over 35 years of research in artificial intelligence and machine learning.

Their algorithm is based on artificial intelligence and machine learning. It incorporates elements of artificial neural networks as well as genetic algorithms through which we analyze, model, and predict the stock market.

The stock market prediction algorithm is scalable and adaptable. It features a Decision Support System (DSS) which helps it to optimize the information produced by the analysis of historical data of past years inputted to the model. It can predict the flow of money in 10,000 markets around the world with predictions for periods ranging from 3-days to a year. It can predict stock prices, ETF movement, world indices, gold, currencies, interest rates, and commodity fluctuations.

Their system is built with insights of Chaos theory and self-similarity, the fractals. They harness the past 15-year daily stock data from Bloomberg and use it to train their Neural Networks coupled with Genetic Algorithms to generate predictions. The historical total returns of up to 83% and Sharpe Ratios up to 1.26 in the 2.5-year period significantly outperform the S&P 500 index and provide an exciting and modern investment opportunity. Apart from this, hybrid machine learning systems based on Genetic Algorithm (GA) and Support Vector Machines (SVM) for stock market prediction making use of technical indicators of highly correlated stocks are also being tested for predicting stock market prices in emerging markets.

In the meantime, you can take “Learn Machine Learning By Building Projects”; an online tutorial that teaches you to build various AI and ML-related projects including Stock Market Clustering, Credit Card Fraud Detection, Board Game Review Prediction and much more.

References: